Context & Constraints

"Clarity over advice. Trust over speed."

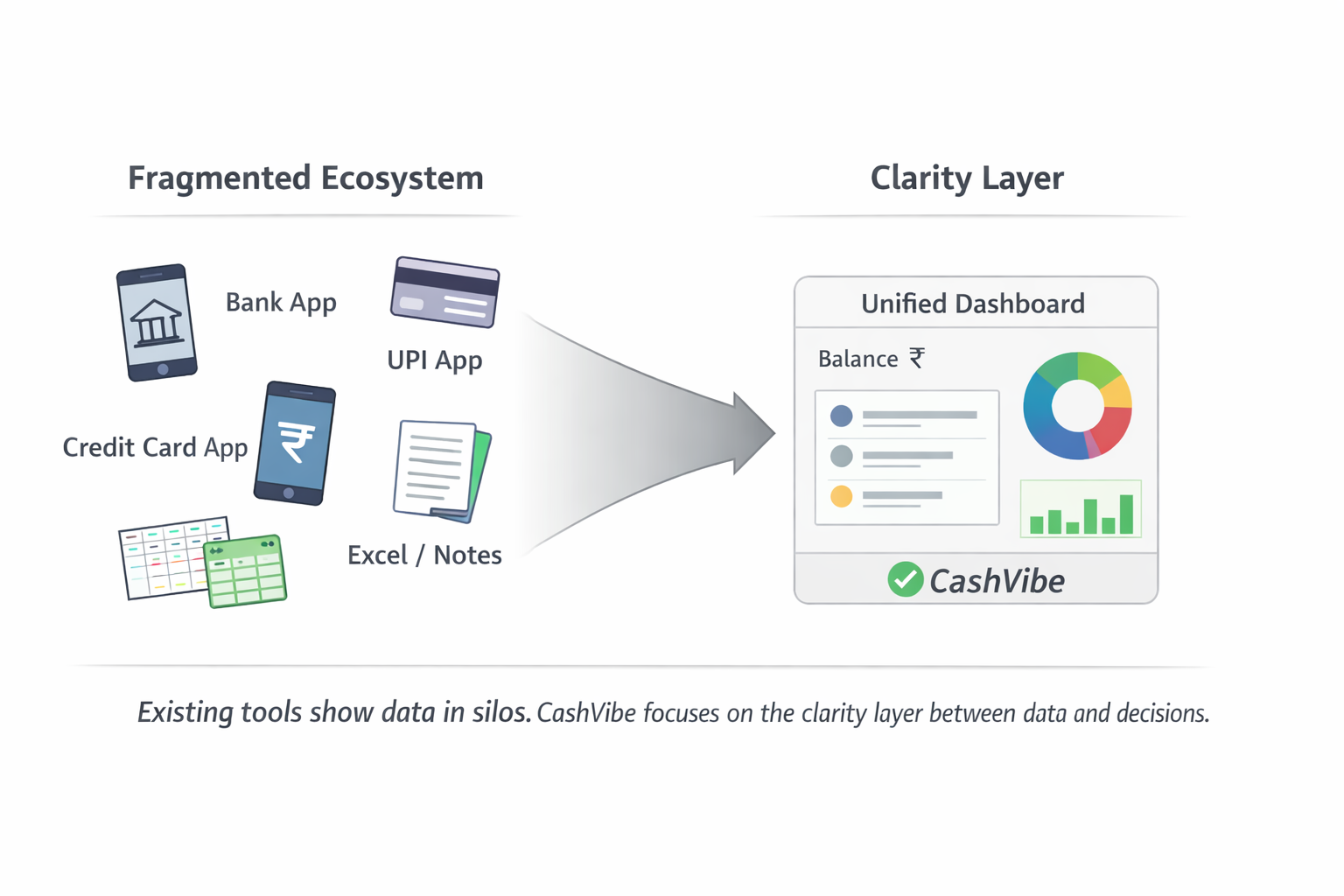

CashVibe was designed for digitally savvy Gen Z users in India who already rely on UPI, bank, and investment apps to manage money. While transactions are frictionless, understanding finances isn’t. Users often stitch information across apps or fall back on Excel and Notes - which demands ongoing manual effort and quickly breaks down.

Trust is the baseline expectation. In a high-stakes, regulated domain like finance, users are quick to disengage from products that feel unsafe, opaque, or overly prescriptive.

The biggest constraint was regulation. Early on, I explored a “Google Maps for finance” idea - showing users where they are, where they want to go, and possible paths forward. In India, however, prescriptive financial guidance requires licensed advisors. Acting like a financial coach was out of scope.

This forced a clear tradeoff: speed vs trust. I chose trust. The product had to stay descriptive rather than prescriptive, focusing on clarity and visibility instead of telling users what to do.